Tsp Roth Ira Contribution Limits 2024 Catch Up

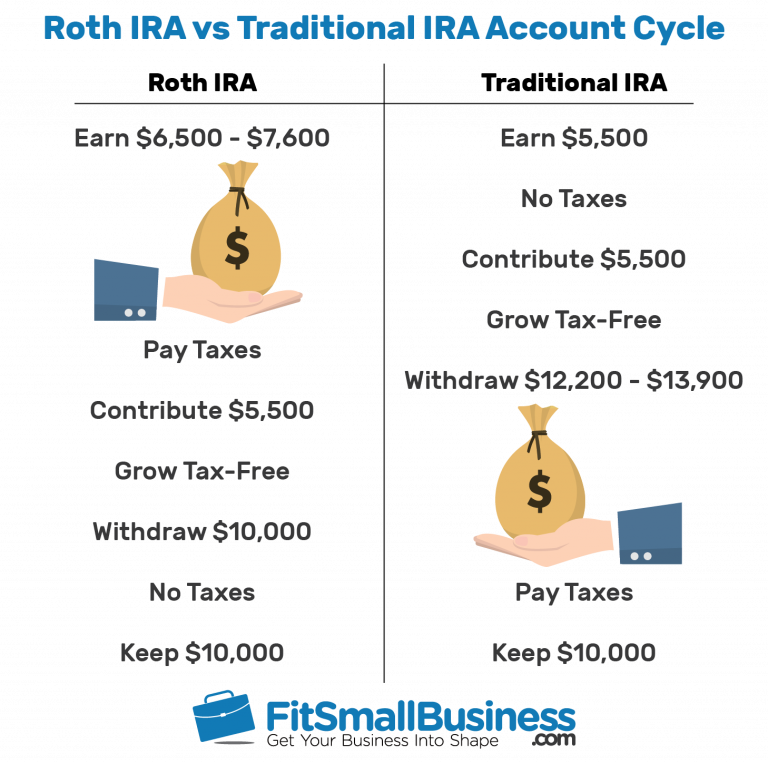

Tsp Roth Ira Contribution Limits 2024 Catch Up. With roth tsp, your contributions go into the tsp after tax withholding. The 2024 ira annual contribution limit is $7,000 per year, up from $6,500 per year in 2023.

The 2024 ira annual contribution limit is $7,000 per year, up from $6,500 per year in 2023. All of this means that federal employees are eligible to contribute $25,500 total.

But There Are Some Changes This Year To Retirement A.

Every year this may or may not change.

For Example, If Your Child Contributes $3,500 To The Account, You Can Chip In $3,500 As Well To Reach The Maximum Roth Ira Contribution Amount Of $7,000 In 2024.

You can contribute up to $7,000 to traditional.

To Contribute To A Roth Ira (And Score Those Sweet Tax Advantages), You Have To Fall Within The Income Limits Set By The Irs.

Images References :

Source: carenaqelbertine.pages.dev

Source: carenaqelbertine.pages.dev

2024 Tsp Catch Up Contribution Limits Sula Bettina, That means you pay taxes on your contributions at your current income tax rate. The limit on annual contributions to an ira increased to $7,000, up from $6,500.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, To be eligible to contribute the maximum. For example, if your child contributes $3,500 to the account, you can chip in $3,500 as well to reach the maximum roth ira contribution amount of $7,000 in 2024.

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2024 Finance Strategists, For example, if your child contributes $3,500 to the account, you can chip in $3,500 as well to reach the maximum roth ira contribution amount of $7,000 in 2024. The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Source: www.bestpracticeinhr.com

Source: www.bestpracticeinhr.com

Roth IRA Rules, Contribution Limits & Deadlines Best Practice in HR, The $10,000 limit will also be. To contribute to a roth ira (and score those sweet tax advantages), you have to fall within the income limits set by the irs.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021, Members aged 50 and over can contribute an additional $7,500 per year to their elective deferral limit ($30,500) and. To contribute to a roth ira (and score those sweet tax advantages), you have to fall within the income limits set by the irs.

Source: directedira.com

Source: directedira.com

Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, That means you pay taxes on your contributions at your current income tax rate. All of this means that federal employees are eligible to contribute $25,500 total.

Source: www.savingtoinvest.com

Source: www.savingtoinvest.com

Roth IRA contribution limits — Saving to Invest, What are the contribution limits for retirement accounts in 2024? But there are some changes this year to retirement a.

Source: choosegoldira.com

Source: choosegoldira.com

401k vs roth ira calculator Choosing Your Gold IRA, The $10,000 limit will also be. The ira catch‑up contribution limit for individuals aged 50 and over was amended under the.

Source: valenkawkit.pages.dev

Source: valenkawkit.pages.dev

2024 Catch Up Limit Camel Corilla, Every year this may or may not change. You can contribute up to $7,000 to traditional.

Source: drediqlarine.pages.dev

Source: drediqlarine.pages.dev

Ira Distribution Limits 2024 Katey Dolorita, Select an option and take a look. For example, if your child contributes $3,500 to the account, you can chip in $3,500 as well to reach the maximum roth ira contribution amount of $7,000 in 2024.

Below Are The 2024 Irs Limits And Additional Information To Keep You Informed.

After raising the limits in each of the past several years, the irs has announced that it will raise them again for 2025 to account for inflation.

To Be Eligible To Contribute The Maximum.

For example, if your child contributes $3,500 to the account, you can chip in $3,500 as well to reach the maximum roth ira contribution amount of $7,000 in 2024.